안전놀이터의 신뢰도를 높이는 이박사 플랫폼: 유쾌한 소통!

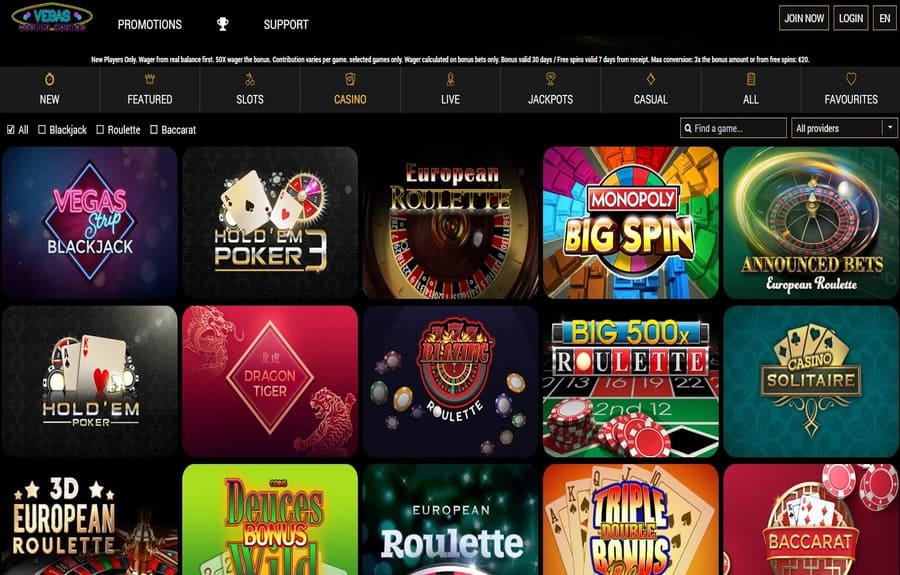

안전놀이터의 중요성과 이박사의 역할 안전놀이터는 온라인 놀이 환경에서 사용자의 안전과 신뢰를 보장하는 중요한 요소입니다. 이박사 플랫폼은 이러한 안전놀이터를 추천하고 보증하는 중추적인 역할을 합니다. 사용자들에게 안전한 게임 환경을 제공함으로써, 신뢰도 높은 놀이터 경험을 가능하게 하는 것이 이박사의 주된 목표입니다. 이를 통해 사용자는 걱정 없이 게임을 즐길 수 있으며, 플랫폼은 지속적으로 엄선된...